United Kingdom Offshore Decommissioning Market Size - Analysis

The United Kingdom offshore decommissioning market size is expected to reach US$ 2.53 Bn by 2032, from US$ 1.41 Bn in 2025, growing at a CAGR of 8.7% during the forecast period 2025-2032. The offshore decommissioning market in the UK is projected to grow significantly in the coming years. With an aging oil and gas infrastructure many operators are expected to undertake decommissioning projects of platforms and pipelines to plug and abandon wells, remove topsides and jackets, and clear the seabed according to UK regulation.

United Kingdom Offshore Decommissioning Market Drivers

- Growing number of mature oil and gas fields: The decommissioning of offshore oil and gas infrastructure in the UK North Sea is becoming a major industry as many of the fields have passed their peak production and are becoming depleted. Over the past few decades, hundreds of oil and gas platforms have been installed in the North Sea but most major fields are now in the late stage of their productive lifespan. For instance, according to OGUK economic reports a total cumulative sum of US$ 16.57 billion is forecast to be spent on decommissioning activities in the U.K. section of the North Sea by 2032. The growing expenditure estimates highlight the increasing scale of work required to be carried out by specialized contractors and are supporting the continued expansion of the U.K. offshore decommissioning market in the coming years.

- Increasing expenditure on offshore decommissioning projects: The demand for offshore decommissioning activities has been steadily rising in the United Kingdom over the past decade. As several aging oil and gas assets in the North Sea are reaching the end of their productive life, expenditure on decommissioning these offshore rigs and platforms is set to increase substantially in the coming years. Decommissioning the infrastructure involves complex engineering tasks such as removing topsides, substructures, and pipelines. It also requires expertise in waste management and environmental protection to safely dismantle and dispose the facilities with minimal impact.

United Kingdom Offshore Decommissioning Market Restraints

- Environmental legislations and authorization delays: Environmental legislations and authorization delays are posing significant challenges to the growth of the United Kingdom offshore decommissioning market. Strict environmental norms aim to ensure offshore structures are dismantled and removed in an eco-friendly manner with minimal impact on the marine environment. However, the complex authorization processes involved in fulfilling the compliance requirements has led to project delays.

- Obtaining the necessary approvals from regulatory bodies like the Department for Business, Energy and Industrial Strategy and the Oil and Gas Authority is a lengthy process. It requires the completion of extensive documentation work, environmental impact assessments, and stakeholder consultations. For instance, as per a 2021 report by the Environmental Audit Committee, it took three years to receive consent for the decommissioning of the Brent Delta platform, one of the largest platforms in the U.K. North Sea. The report highlighted how such delays increase the costs of projects substantially.

- Lack of skilled workforce: The lack of a skilled workforce is a major challenge restricting the growth of the United Kingdom offshore decommissioning market. Offshore decommissioning requires personnel with very specialized technical skills and experience to safely dismantle platforms and infrastructure located in deep waters. However, there is currently a shortage of workers with the necessary qualifications and training to take on decommissioning projects. As most of the existing offshore oil and gas infrastructure in U.K. waters is ageing and approaching end of life, the demand for decommissioning activities is expected to surge in the coming years. However, if the skills gap is not addressed proactively, it could hinder the sector's ability to ramp up operations and create bottlenecks.

- The skills gap also makes the sector heavily reliant on contracting overseas workers. However, this increases project costs due to higher wages. Recruiting from other countries also poses logistical challenges. For example, according to the International Labour Organization data from 2025, over 30% of the current U.K. offshore oil and gas workforce comprises expatriate employees. Unless domestic skills development is prioritized, this dependence on foreign hiring will continue restricting the efficient expansion of decommissioning activity and contribute to delays and budget overruns in projects.

United Kingdom Offshore Decommissioning Market Opportunity

- Advancing decommissioning technologies: Advancing decommissioning technologies could provide a significant opportunity for growth in the United Kingdom offshore decommissioning market. As the U.K. continental shelf matures, an increasing number of offshore oil and gas infrastructure will require decommissioning in the coming decades the oil and gas industry has made real progress to reduce costs, find efficiencies and improve collaboration which, combined with recent fiscal changes, has served to make the UK an attractive destination for new investment in oil and gas projects. For instance, there are an estimated 10 to 20 billion barrels of oil equivalent remaining under the United Kingdom’s Continental Shelf (UKCS) and this government is committed to the strategy of maximizing economic recovery and will continue to support this vital sector of the economy. The potential opportunity for advancing technologies in the United Kingdom offshore decommissioning market appears considerable. Innovation that drives efficiency and cost competitiveness has scope to stimulate increased activity as a large number of aged offshore assets now require removal.

- Re-use and re-purposing of decommissioned assets: Re-use and re-purposing of decommissioned offshore assets can certainly harness a great opportunity in the United Kingdom offshore decommissioning market. Many of these rigs, platforms, and pipelines are built to last and still have useful working life left in them. Instead of scrapping them, they can be converted into artificial reefs, renewable energy hubs or production facilities. For instance, some large platforms in shallower waters have been converted into fish farms and marine research stations. This type of asset re-purposing not only reduces decommissioning costs significantly but also creates new offshore jobs. It allows an extended use of existing infrastructure to boost other maritime industries like offshore wind, wave and tidal energy production. If encouraged through policy reforms and financial incentives, asset re-purposing clearly has immense potential to power the continuous development of the U.K. offshore sector sustainably for decades to come.

Analyst view point

The UK offshore decommissioning market is poised to grow significantly over the next decade, driven mainly by aging infrastructure in the North Sea. Many offshore oil and gas platforms and pipelines are nearing or past their design life, requiring dismantlement and removal. This presents sizable opportunities for decommissioning contractors to fulfill clean-up and remediation work. However, high costs associated with complex dismantlement projects could hamper market expansion. Regulations around environmental remediation are increasingly stringent, adding to project budgets. Additionally, uncertainty over framework agreements between operators and UK regulators risks delaying some projects. That said, the UK Continental Shelf still hosts considerable oil and gas reserves, suggesting ongoing investment to maximize economic recovery. As production plateaus from maturing fields, there will be a corresponding rise in decommissioning activity. The concentrated nature of infrastructure in the North Sea positions the UK market as one of the worlds largest for offshore decommissioning in the coming decade. Scotland in particular is poised to dominate as operator focus shifts to complex, large-scale rig removals in the region. Younger offshore sites in the Irish Sea also offer opportunities for partial and full removal projects going forward. If constraints around post-Brexit trade are managed smoothly, international contractors will look to capture work stemming from the substantial UK decommissioning pipeline.

Market Size in USD Bn

CAGR8.7%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 8.7% |

| Market Concentration | High |

| Major Players | Veolia Environnement S.A., Derrick Services (UK) Ltd, Perenco SA, Ramboll Group A/S, AF Gruppen ASA and Among Others |

please let us know !

United Kingdom Offshore Decommissioning Market Trends

- Rising popularity of partial decommissioning: The popularity of partial decommissioning is having a significant influence on the offshore decommissioning market in the United Kingdom. With partial decommissioning, only part of an offshore oil and gas infrastructure is removed while other parts continue to be used. This trend is driven by factors such as reducing project costs and environmental impacts as well as potential for redevelopment and future energy uses. Partially decommissioned structures can potentially be redeveloped and reused for different energy generation.

- As per the Oil and Gas Authority (OGA), the reuse of existing offshore facilities for activities like carbon capture utilization and storage (CCUS) or renewable energy reduces future costs of developing new infrastructure from scratch. OGA's survey from 2025 reported that over 50% of partially decommissioned assets in the U.K. can be repurposed for low-carbon energy projects in the next 10-15 years. This is a major driver for operators to opt for judicious partial decommissioning over immediate full removals. This trend is likely to grow stronger as industry and regulators explore new opportunities for transitioning aging oil & gas assets towards sustainable energy generation.

- Growing focus on the reuse and recycling of materials: The growing focus on the reuse and recycling of materials is having a significant influence on the United Kingdom offshore decommissioning market. With increased emphasis on sustainability and reducing environmental impacts, there is now a strong drive among oil and gas operators to find viable reuse options for infrastructure being decommissioned from offshore sites, rather than pursuing traditional direct disposal routes. This allows valuable materials and components to get a second lifecycle rather than being scrapped. As a result, reuse and recycling are fast becoming viewed as important value recovery and extraction strategies within depletion and decommissioning projects. For instance, offshore wind farms present opportunities for second use as they require similar materials and components to initially set up wind turbines. The Crown Estate, which manages the U.K.'s seabed, published data in 2022 stating that 27 wind turbine foundations and six substations were reused from oil and gas platforms for new wind farms between 2020 and 2022, preventing over 90,000 tons of steel from being scrapped.

Segmental Analysis of United Kingdom Offshore Decommissioning Market

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample CopyCompetitive overview of United Kingdom Offshore Decommissioning Market

Acteon Group Limited, Topicus Finan BV, Tetra Technologies Inc., Allseas Group S.A., DeepOcean Group Holding B.V., John Wood Group Plc, Exxon Mobil Corporation, Veolia Environnement S.A., Derrick Services (UK) Ltd., Perenco SA, Ramboll Group A/S, and AF Gruppen ASA.

United Kingdom Offshore Decommissioning Market Leaders

- Veolia Environnement S.A.

- Derrick Services (UK) Ltd

- Perenco SA

- Ramboll Group A/S

- AF Gruppen ASA

Recent Developments in United Kingdom Offshore Decommissioning Market

- In November 2022, there were more than 2,000 abandoned oil and gas wells in the North Sea, and the high number of abandoned wells is expected to lead to an increase in activity as operations worth US$ 21.72 billion are decommissioned and shut down. The research was conducted by industry, Offshore Energies UK (OEUK), formerly Oil & Gas UK, which provides fresh insight into petroleum decommissioning efforts.

- The HAF Consortium, Heerema Marine Contractors, and AF Offshore Decom were contracted to execute the operation on behalf of Abu Dhabi National Energy Company PJSC (TAQA). The operation, which was the latest in TAQA’s extensive Uk Continental Shelf decommissioning program, involved the removal and transport of more than 12,000 metric tons of material from the Brae field in the U.K. North Sea.

Acquisition and partnerships

- In June 2023, a global law firm, Norton Rose Fulbright, advised its long-standing client, Appian Capital Advisory LLP (Appian), on the sale of its Atlantic Nickel and Mineraçao Vale Verde mines to ACG Acquisition Company Limited (ACG), a special purpose acquisition companies (SPAC) listed on the London Stock Exchange

- In September 2022, the Nuclear Decommissioning Authority (NDA) of the United Kingdom and the National Decommissioning Centre (NDC) of the United Kingdom signed a three-year collaborative research agreement, the first of its type involving the nuclear and oil and gas decommissioning industries.

*Definition: Adaptive clothing refers to garments that are designed to meet the needs of individuals with physical, cognitive, or sensory limitations. These clothes are created to make it easier for people to dress themselves or to assist caregivers in dressing others.

United Kingdom Offshore Decommissioning Market Segmentation

- By Service:

- Removal

- Disposal

- Remediation and Environmental Studies

- Modelling and Sampling

- Waste Mapping and Handling

- Others (Stress Analysis, Lifting and Rigging Procedures, etc.)

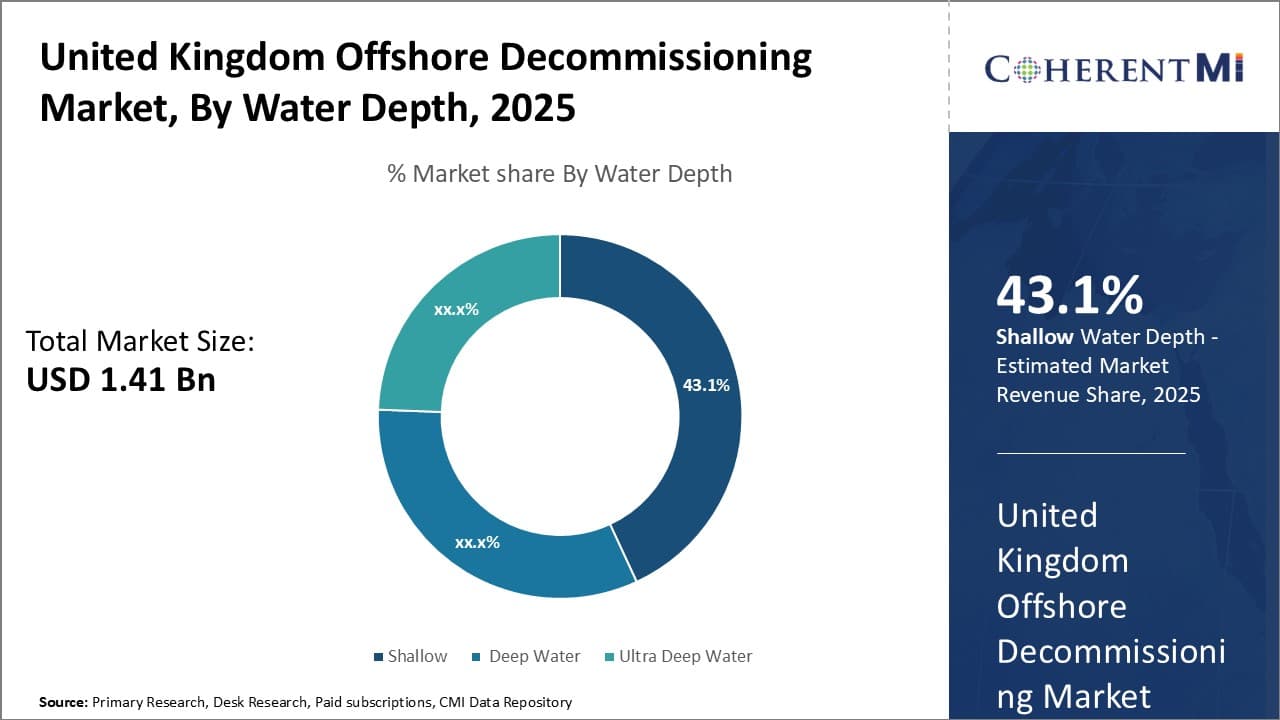

- By Water Depth:

-

- Shallow

- Deep Water

- Ultra Deep Water

Would you like to explore the option of buying individual sections of this report?

Sakshi Suryawanshi is a Research Consultant with 6 years of extensive experience in market research and consulting. She is proficient in market estimation, competitive analysis, and patent analysis. Sakshi excels in identifying market trends and evaluating competitive landscapes to provide actionable insights that drive strategic decision-making. Her expertise helps businesses navigate complex market dynamics and achieve their objectives effectively.