Published Date: Jan 2025

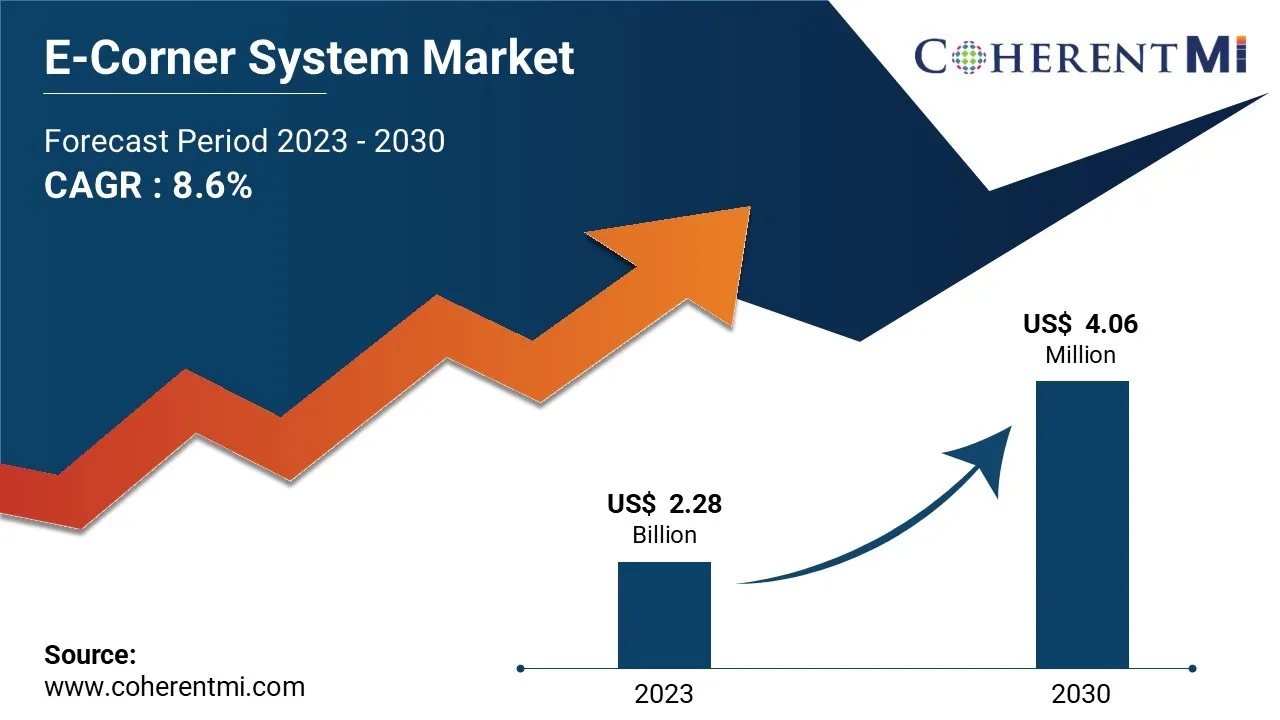

The e-corner system market is estimated to be valued at US$ 2.28 Bn in 2023 and is expected to exhibit a CAGR of 8.6% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights. Heavy investments in space programs across the globe and growing applications of small satellites across industries will be the driving force of the e-corner systems market.

Key Market Takeaways:

The global e-corner system market is anticipated to witness a CAGR of 8.6% during the forecast period 2023-2030, owing to rapid digitization and the growing importance of online shopping especially after the pandemic.

- On the basis of component type, the antenna segment is expected to hold a dominant position, owing to its crucial role in enabling communication between different components of an e-corner system.

- On the basis of satellite type, the LEO - Low Earth Orbit segment is expected to hold a dominant position over the forecast period, due to the advantages of low latency and cost-efficiency that LEO satellites provide.

- On the basis of end-use industry, the commercial segment is expected to hold a dominant position over the forecast period.

- On the basis of application, the communication segment is expected to hold a dominant position, due to increased data exchange between different components of an e-corner system.

- Regionally, North America is expected to hold a dominant position over the forecast period, due to high technology adoption and the presence of major players in the region.

E-Corner System Market Report Coverage

|

Report Coverage |

Details |

|

Market Revenue in 2023 |

USD 2.28 Billion |

|

Estimated Value by 2030 |

USD 4.06 Billion |

|

Growth Rate |

Poised to grow at a CAGR of 8.6% |

|

Historical Data |

2018–2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

By Component Type, By Satellite Type, By End-user Industry, By Application |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Growth Drivers |

• Increasing Investments in Space Exploration Missions • Growing Applications of Small Satellites |

|

Restraints & Challenges |

• High Costs and Complexities of Development |

Market Dynamics:

The e-corner system market is being driven by growing demand from automotive and aerospace industries. E-corner system improves vehicle agility and reduces weight compared to traditional hydraulic systems. These benefits have increased their adoption in premium and luxury vehicles.

Market Trends:

- E-corner systems improve vehicle maneuverability which is a key requirement for commercial vehicles operating in congested urban areas. Technologies such as automated guided vehicles (AGVs) utilized by logistics companies heavily rely on advanced cornering capabilities. This is expected to drive the adoption of e-corner systems in commercial vehicle segment.

- Leading companies such as Waymo and Cruise Automation utilize e-corner systems to achieve superior steering and suspension control for their autonomous vehicles. Thus, growing customer base of on-demand mobility is projected to propel the e-corner system market.

Market Opportunities:

- In the satellite industry, additive manufacturing methods such as 3D printing are increasingly used to produce complex, lightweight designs. Antennas and waveguide filters demonstrate how 3D printing can enhance performance by enabling intricate geometries and reduced mass. This can create new opportunities in the e-corner system market.

- Additionally, growing demand for electric vehicles is also supplementing market growth as e-corner systems improve vehicle dynamics in EVs. Rising concerns regarding vehicular safety and performance are further propelling the e-corner system market.

Competitor Insights

Key players in the e-corner system market include:

- Beijing Aerospace Times Optical-Electronic Technology Co., Ltd.

- China Aerospace Leading Science & Technology Co., Ltd.

- China Aerospace Science and Industry Corporation

- China Electronics Technology Group Corporation

- China Spacesat Co., Ltd.

- Chinas Great Wall Industry Corporation

- China Academy of Space Technology

- Dongfanghong Satellite Co., Ltd.

- Guodian Gaoke

- Shanghai Academy of Spaceflight Technology

Recent Developments:

- In August 2023, Hyundai Mobis announced that it recently showcased multiple driving modes on a Hyundai Motor Company IONIQ 5 test vehicle equipped with its e-corner system, conducting trials at the Seosan Test Drive Circuit and on nearby roads.

Market Segmentation:

- By Component Type

-

- Antenna

- Transponder

- Amplifier

- Frequency Converter

- Diplexer

- Multiplexer

- Others (Modulator, Demodulator, etc.)

- By Satellite Type

-

- LEO

- MEO

- GEO

- Others (HEO, Elliptical, etc.)

- By End-use Industry

-

- Commercial

- Government & Military

- Others (Academic, Non-profit, etc.)

- By Application

-

- Communication

- Earth Observation & Remote Sensing

- Science & Exploration

- Navigation & Mapping

- Surveillance & Security

- Others (Weather forecasting, etc.)

- By Region:

-

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- North America

Related Reports :