United States Oil and Gas Chemicals Market Size - Analysis

The United States Oils and Gas Chemicals Market is estimated to be valued at USD 21.32 Bn in 2025 and is expected to reach USD 29.21 Bn by 2032, growing at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2032.

The market is expected to witness positive growth over the forecast period. With rising energy demands and increasing demand from the petrochemicals industry, the consumption of oil and gas chemicals is likely to increase substantially. However, stringent environmental regulations aimed at curbing greenhouse gas emissions could pose a challenge to the market's growth.

Market Size in USD Bn

CAGR4.6%

| Study Period | 2025-2032 |

| Base Year of Estimation | 2024 |

| CAGR | 4.6% |

| Market Concentration | High |

| Major Players | EXXON MOBIL, CHEVRON, ConocoPhillips, Schlumberger, Eog Resources and Among Others |

please let us know !

United States Oil and Gas Chemicals Market Trends

Market Driver - Increasing Production of Crude Oil

The rapid rise in oil production across the U.S. has significantly boosted domestic supplies of raw materials for the oils and gas chemicals industry. According to the U.S. Energy Information Administration, U.S. field production of crude oil increased from around 11 million barrels per day in 2010 to nearly 13 million barrels per day in 2021.

With much of this additional oil coming from prolific shale reserves unlocked by advances in hydraulic fracturing and horizontal drilling, petrochemical manufacturers now have greater access to affordable feedstocks close to home.

As a result, production of basic petrochemicals and derivatives such as ethylene, propylene, benzene and xylene that serve as building blocks for numerous consumer and industrial products has grown commensurately over the past decade. This expansion in chemicals output has been led by major industrial hubs along the U.S. Gulf Coast that have a strategic advantage as they are located near major oil and gas fields as well as existing infrastructure for transport and export.

Market Driver - Expansion of Shale Gas Exploration

The expansion of shale gas exploration through hydraulic fracturing or fracking has been a major driver for the growth of the United States oils and gas chemicals market over the past decade. By extracting shale gas from tight rock formations deep underground, vast new sources of natural gas have become accessible across large parts of the country. This has substantially increased domestic natural gas production and transformed the United States into a net exporter of Liquefied Natural Gas (LNG) in recent years.

The commissioning of all this new shale gas-based chemical production capacity is driving tremendous volume growth across the entire downstream product chain. According to the U.S. Energy Information Administration, U.S. production of ethylene, the predominant basic petrochemical used as a feedstock for plastics, synthetic rubber, and other products, rose from 13.8 million metric tons in 2010 to over 19 million metric tons in 2020. This trend is expected to continue as major facilities like Shell's Pennsylvania Petrochemicals Complex reach full operation over the coming years.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Market Challenge - Geopolitical Issues in the Middle East Region

The geopolitical issues in the Middle East region have created significant challenges for the growth of the United States oils and gas chemicals market in recent years. The ongoing conflicts and tensions amongst countries in West Asia have led to instability across the region. This heightened political uncertainty has disrupted trade routes as well as exploration and production activities for oil and gas.

Several parts of the Middle East like Syria, Yemen, Iraq and Libya have witnessed prolonged periods of civil war and unrest over the past decade. This has drastically reduced oil production from these nations. According to data from the US Energy Information Administration, Libya’s oil production declined from 1.2 million barrels per day in 2010 to under 0.1 million barrels per day in 2020 due to the volatile security situation.

Similarly, Iraq could not produce close to its capacity of 4 million barrels per day due to militant attacks and internal conflicts. The supply shortages created by the conflicts have supported higher global oil prices which negatively impact the competitiveness of chemical products manufactured using oil and gas.

Market Opportunity– Exploration of New Oil Fields

Exploration of new oil fields could bring tremendous opportunities in the United States oils and gas chemicals market. As per the Energy Information Administration (EIA), approximately 75% of the crude oil reserves in the United States are yet to be discovered. Tapping into these undiscovered reserves can help boost domestic production and reduce reliance on imports. Several frontier areas such as the Eastern Gulf of Mexico, Atlantic Outer Continental Shelf and Alaska offer high potential for sizeable discoveries. Exploring these regions requiring advanced technologies including 3D seismic surveys and horizontal drilling can open up new frontiers of growth.

Successful exploration of lucrative fields will also attract major investments in midstream and downstream sectors. New oil production will need to be transported through expanded pipeline networks and processed in new or upgraded refineries as well as petrochemical plants. This will stimulate massive capital investments and create numerous jobs directly in the E&P sector and also in associated infrastructural areas.

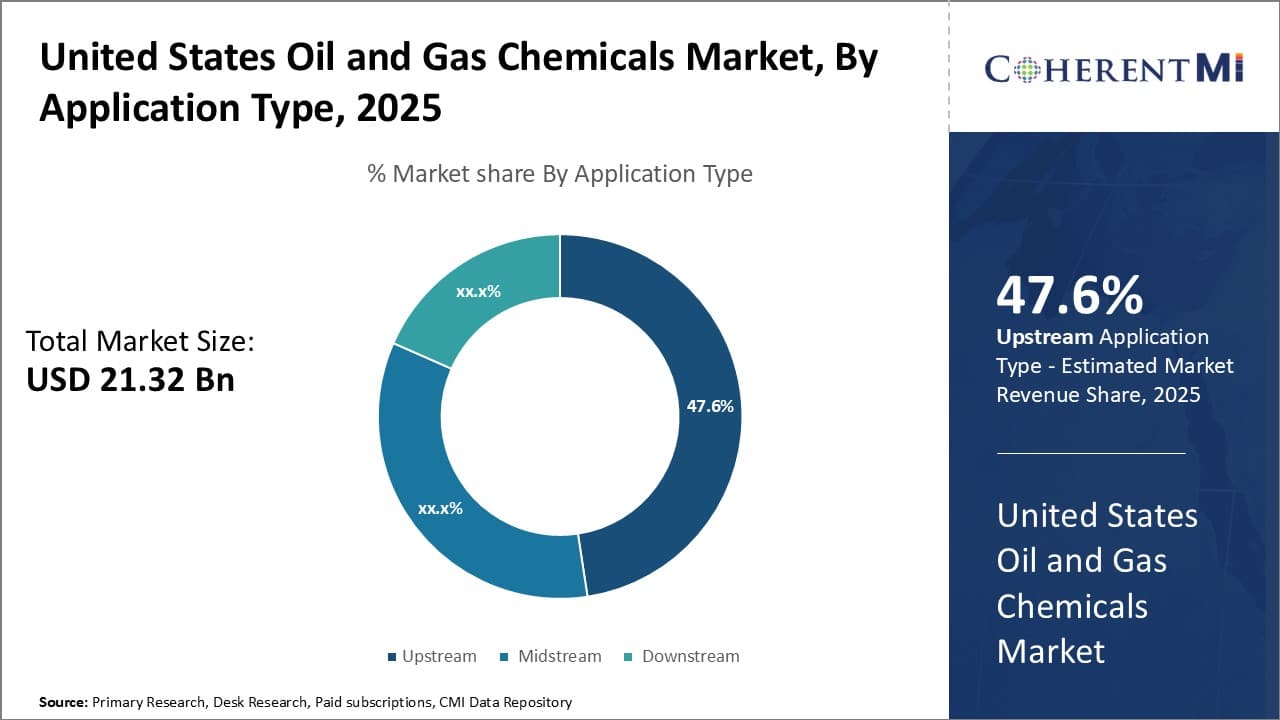

Segmental Analysis of United States Oil and Gas Chemicals Market

To learn more about this report, Download Free Sample Copy

Insights, By Application Type: Active exploration and production activities driving the growth of upstream segment

To learn more about this report, Download Free Sample Copy

Insights, By Application Type: Active exploration and production activities driving the growth of upstream segment

The upstream segment contributes the highest share of 47.6% in 2025 in the United States oils and gas chemicals market due to active exploration and production activities. The upstream sector focuses on exploration and production of oil and natural gas from underground wells and reservoirs. This includes all onshore and offshore operations involved in finding and extracting oil and gas deposits along with constructing, acquiring and installing facilities for the same.

The United States has a well-established oil and gas industry with significant exploration and production projects in various regions within the country. Major oil-producing states like Texas, Alaska and North Dakota have witnessed substantial upstream investment towards drilling new wells and increasing output from mature fields. Streamlining exploration through advanced seismic surveying and drilling techniques has further augmented upstream activity.

With sizable untapped reserves awaiting monetization, the upstream segment relies heavily on chemicals for enhancing exploration success as well as optimizing production. Drilling fluids, blowout preventers and cementing formulations form an important part of well construction while stimulation chemicals aid in recovering trapped reserves. Hence, the large-scale upstream operations make it the dominant end-use area for oils and gas chemicals in the United States market.

To learn more about this report, Download Free Sample Copy

To learn more about this report, Download Free Sample Copy

Insights, By Type: Corrosion Inhibitors to dominate the United States oil & gas chemicals market in 2024

Corrosion inhibitors segment account for the largest share of 23.7% in 2025 in the United States oils and gas chemicals market in terms of application due to widespread utilization at multiple stages of the industry value chain. These chemicals play a vital role in protecting equipment from corrosion during production, transportation as well as refining of crude oil and natural gas.

During oil and gas extraction at well-sites, corrosion inhibitors are commonly injected into production streams to prevent internal and external corrosion of pipes, subsurface safety valves and manifold assemblages. Their use aids in elongating asset life while ensuring smooth operations.

Similarly, these chemicals form tank coatings and are added to pipeline flows to safeguard infrastructure during midstream transportation of hydrocarbons over long distances.

At refineries, corrosion inhibitors find diverse applicability in units dealing with feed pre-treatment, fractional distillation, catalytic cracking and other refining processes. Their deployment shields critical process equipment like reactors, fractionators, pumps and storage tanks. This allows for non-stop refining activities and maintenance of quality standards.

Competitive overview of United States Oil and Gas Chemicals Market

The major players operating in the United States oils and gas chemicals market include EXXON MOBIL, CHEVRON, ConocoPhillips, Schlumberger, Eog Resources, Enterprise Product Partner, Philips 66, Marathon Petroleum, Pioneer Natural Resources, & Occidental Petroleum.

United States Oil and Gas Chemicals Market Leaders

- EXXON MOBIL

- CHEVRON

- ConocoPhillips

- Schlumberger

- Eog Resources

Recent Developments in United States Oil and Gas Chemicals Market

- In November 2023, ExxonMobil acquired Denbury. This will result in expansion of low carbon leadership and positioned to meet the decarbonization needs of customers.

- In March 2024, Chevron and JX sign MOU for collaboration on development of CCS value chain to evaluate the export of Carbon Dioxide (CO2) from Japan to Carbon Capture and Storage (CCS) projects located in Australia and other countries in the Asia Pacific region.

- On December 11, 2023, Occidental to acquire CrownRock, strengthening its U.S. onshore portfolio with Premier Permian Basin Assets. It will give opportunity to build scale in the Midland Basin and better positioning to drive value creation for our shareholders.

- In March 2024, SLB announces agreement to acquire majority ownership in Aker Carbon Capture. SLB and Aker Carbon Capture will combine technology portfolios, expertise and operations platforms to bring carbon capture solutions to market more quickly and more economically.

United States Oil and Gas Chemicals Market Segmentation

- By Application Type

- Upstream

- Midstream

- Downstream

- By Type

- Corrosion inhibitors

- Emulsion breakers

- Cementing super plasticizers

- Paraffin dispersants

- Drilling additives

- Others

Would you like to explore the option of buying individual sections of this report?

Yash Doshi is a Senior Management Consultant. He has 12+ years of experience in conducting research and handling consulting projects across verticals in APAC, EMEA, and the Americas.

He brings strong acumen in helping chemical companies navigate complex challenges and identify growth opportunities. He has deep expertise across the chemicals value chain, including commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals. Yash is a sought-after speaker at industry conferences and contributes to various publications on topics related commodity, specialty and fine chemicals, plastics and polymers, and petrochemicals.